Is Pocket Option Regulated In? A Comprehensive Examination

Pocket Option is a popular online trading platform that offers trading in various financial instruments, including forex, commodities, and cryptocurrencies. One of the most important questions for potential traders is whether this platform is regulated. Understanding the regulatory status of any trading platform is crucial as it directly impacts the safety and security of the traders’ funds. In this article, we will delve into the details of whether Pocket Option is regulated, what that means for traders, and the implications of trading with this platform. For those interested in mobile trading, you can is pocket option regulated in the us قم بتحميل بوكيت أوبشن للكمبيوتر for enhanced accessibility.

What is Regulation in the Trading World?

Regulation is a term that denotes the oversight of financial markets by governmental authorities to ensure fair trading practices and to protect investors. Financial regulators enforce rules that brokers and traders must follow, which can include maintaining certain standards of conduct, ensuring the security of client funds, and maintaining transparency in operations. Regulators vary from country to country and may include organizations such as the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the USA, or the Australian Securities and Investments Commission (ASIC).

Is Pocket Option Regulated?

Pocket Option operates under the name Gembell Limited and is registered in the Republic of the Marshall Islands. As of now, it is not regulated by any major financial authority such as the FCA, SEC, or ASIC. This lack of regulation could raise red flags for some potential traders, mainly because a regulated broker is typically seen as safer due to the oversight and accountability that regulations mandate.

The Risks of Trading with Unregulated Brokers

Trading on an unregulated platform such as Pocket Option comes with its own set of risks. Here are a few considerations:

- Less Protection: If something goes wrong, such as a dispute over trades or fund withdrawals, there is no regulator to mediate or resolve conflicts.

- Risk of Fraud: Unregulated brokers may not adhere to strict financial practices, which can lead to potential scams or fraud. Traders should be wary of platforms that do not provide clear information about their operations.

- No Guarantees: Traders may find that they have no recourse if the broker engages in unethical practices, such as manipulating prices or refusing to honor withdrawals.

Understanding the Benefits of Regulated Brokers

Choosing to trade on a regulated platform can significantly affect the safety of your investments. Here are some advantages of trading with regulated brokers:

- Increased Trust: Regulation adds a layer of trust, as traders can be confident that the broker will adhere to established standards and practices.

- Security of Funds: Regulated brokers often segregate client funds in separate accounts to ensure that they are secure and not used for operational expenses.

- Dispute Resolution: If issues arise, regulatory bodies can help resolve disputes between traders and brokers more efficiently.

What Makes Pocket Option Attractive Regardless of Regulation?

Despite its lack of regulation, Pocket Option has become attractive to many traders for numerous reasons:

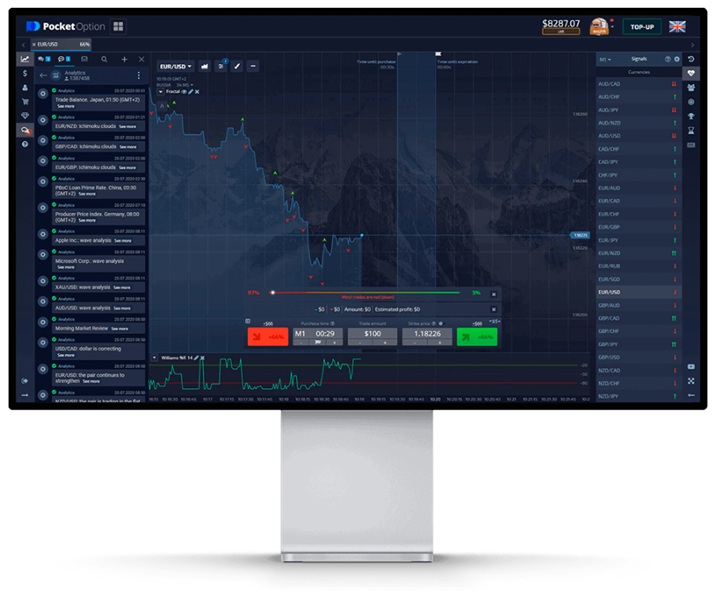

- User-Friendly Interface: The platform provides an intuitive and easy-to-navigate interface, making it accessible for beginners.

- Wide Range of Assets: Traders can access various financial instruments, including forex, cryptocurrencies, stocks, and commodities.

- Multiple Payment Methods: Pocket Option supports various deposit and withdrawal methods, including cryptocurrencies, which can be appealing to different traders.

What Should Potential Traders Consider?

When considering trading with Pocket Option or any unregulated broker, potential traders should take the following factors into account:

- Research the Broker: Look for reviews and experiences from other traders. Understanding the community’s sentiment towards the broker can provide insights.

- Test the Platform: Utilize any demo accounts the broker may offer to test the platform without risking real money.

- Risk Management: Use proper risk management techniques, especially when trading on platforms lacking regulatory oversight.

Conclusion

In summary, while Pocket Option provides a range of appealing features that attract traders, it is essential to note that the platform is not regulated. This lack of regulation presents risks that every potential trader must consider seriously. Whether you choose to proceed with trading on Pocket Option or prefer to seek regulated alternatives, ensuring thorough research and adequate risk management is crucial. Always remember that trading involves risks, and informed decision-making is pivotal for success in the financial markets.